closed end loan disclosures

For closed end dwelling-secured loans subject to RESPA does it appear early disclosures are delivered or mailed within three 3 business days after receiving the consumers written application and at least seven 7 business days before consummation. For a closed-end credit transaction subject to 102619e and f opens new window real property or a cooperative unit does the credit union provide disclosures required under 102637 opens new window Loan Estimate and.

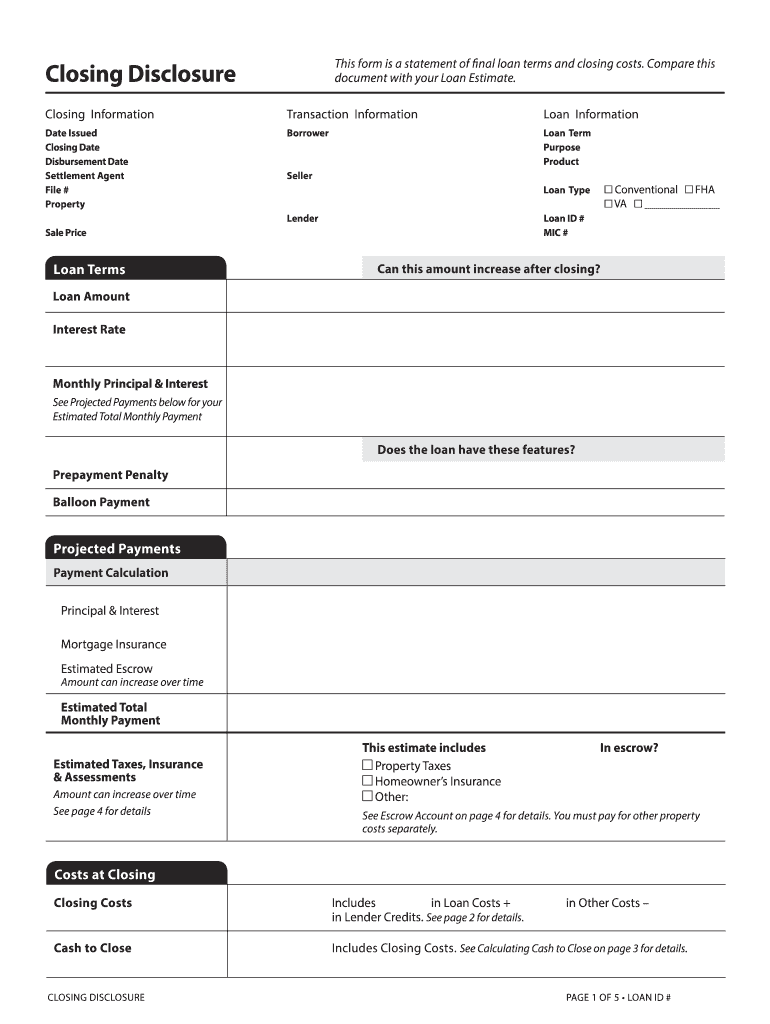

What Is A Closing Disclosure Finance Of America Mortgage

A closed-end line.

. Closed-end consumer credit transactions secured by real property or a cooperative unit other than a reverse mortgage subject to 102633 opens new window are subject to the disclosure timing and other requirements under the TILA-RESPA Integrated Disclosure rule TRID. Only applies to loans for the purpose of purchasing or initial construction of and secured by the consumers principal dwelling. Trigger terms when advertising a closed-end loan include.

In addition federally related mortgage loans generally exclude temporary financing and construction loans. 2 The number of payments or period of repayment. 102637 Content of disclosures for certain mortgage transactions Loan Estimate.

Thus for most closed-end mortgages including construction-only loans and loans. Such disclosures shall be provided by the lending. RESPA does however require that you make certain disclosures within three business days after you receive or prepare an application.

All disclosures required under this Part are to be made in a single separate document in plain language and with captioned subdivisions for the information to be disclosed. Subpart AProvides general information that applies to both open-end and closed-end credit. This requirement is only applicable to first.

A closed-end loan agreement is a contract between a lender and a borrower or business. 22619a1 and 22619a2 10. There are two basic kinds of lines of credit.

If a closed-end credit transaction is converted to an open-end credit account under a written agreement with the consumer account-opening disclosures under 10266 must be given before the consumer becomes obligated on the open-end credit plan. 3 The amount of any payment. Current through Register Vol.

Or 4 The amount of any finance charge. Closed-end mortgage disclosure scheme includes MDIAs amendments to TILA and the disclosure timing requirements implemented by the Board in 2008 through a final rule that preceded MDIAs enactment. Converting closed-end to open-end credit.

For a closed-end transaction secured by real property or a dwelling other than a transaction that is subject to 102619e and the creditor shall disclose a statement that there is no guarantee the consumer can refinance the transaction to. Prepared by Marjorie A. The disclosure rules of Regulation Z differ depend ing on whether the credit is open-end credit cards and home equity lines for example or closed-end such as car loans and mortgages.

See the commentary to 102617 on converting open-end credit to closed. For closed end dwelling-secured loans subject to. Section 332 - Disclosures.

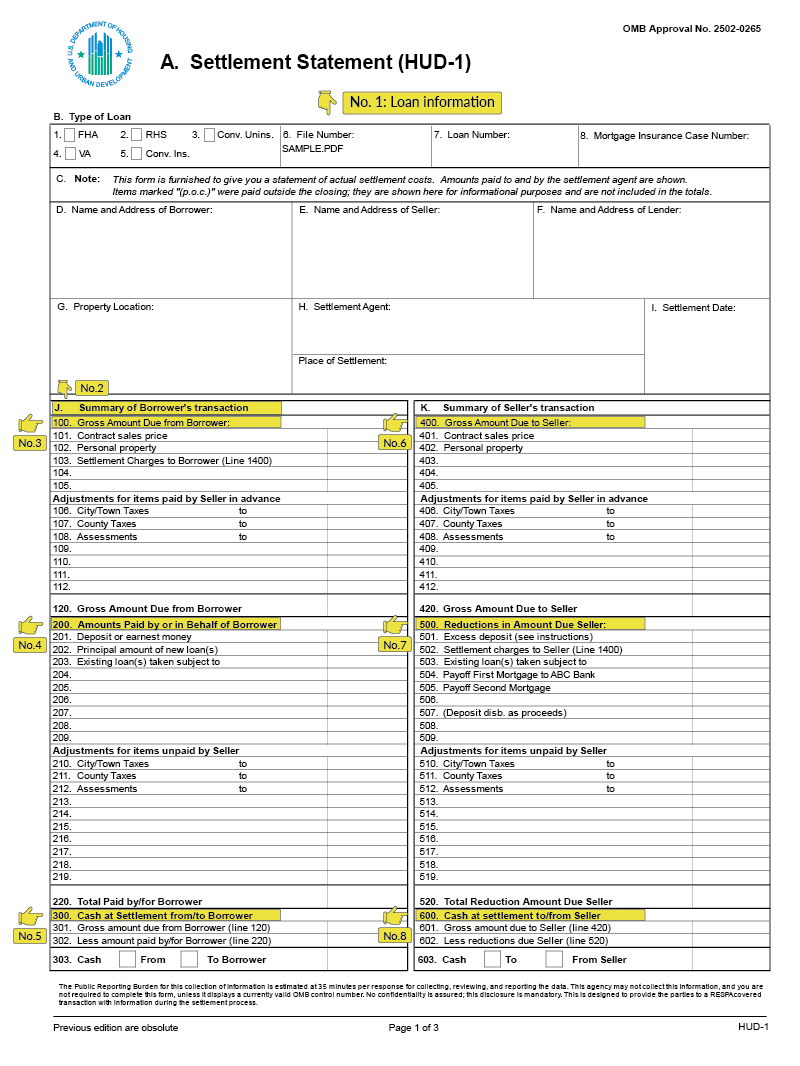

RESPA does not require that any disclosures accompany the application form. While some states have laws requiring the use of a state promulgated form in cash transactions in general the HUD-1 the Closing Disclosure or any other settlement statement can be used in cash transactions. 27 July 6 2022.

The value of a closed-end credit APR must be disclosed as a single rate only whether the loan has a single interest rate a variable interest rate a discounted variable interest rate or graduated payments based on separate interest rates step rates and it. The lender and borrower reach an agreement on the amount borrowed the loan amount the interest rate and the monthly payment all of which are determined by the borrowers credit rating. 102636 Prohibited acts or practices and certain requirements for credit secured by a dwelling.

The Loan Estimate and Closing Disclosure must be used for most closed-end consumer mortgages secured by real property or a cooperative unit. This type of mortgage makes sense for. Home equity lines of credit reverse mortgages and mortgages secured by a mobile home or by a dwelling other than a cooperative unit that is not attached to real property ie.

Stating No downpayment does not trigger additional disclosures. Only applies to purchase-money loans subject to RESPA. 102638 Content of disclosures for certain mortgage transactions Closing Disclosure.

Obtaining a closed-end loan is an effective way for a borrower to. Of the disclosures you list here would be the status in a closed-end home equity loan. The MDIA codified some of the 2008 HOEPA Final Rule and expanded its coverage.

102635 Requirements for higher-priced mortgage loans. A line of credit is a type of loan that borrowers can take money from over time rather than all at once. 1 The amount or percentage of any downpayment.

Closed-end credit is a loan or type of credit where the funds are dispersed in full when the loan closes and must be paid back including interest and finance charges by a specific date. Sample List of Closed-End Residential Mortgage Disclosures Required to be Given to Consumers at Loan Application by Maryland Mortgage Lenders and Brokers. If your home equity plan is closed-end Truth in Lending does not require any disclosures accompany the application form.

A restrictive type of mortgage that cannot be prepaid renegotiated or refinanced without paying breakage costs to the lender. Regulation Z is structured accordingly. 73 FR 44522 July 30 2008 2008 HOEPA Final Rule.

Depends on lien position. In a closed-end consumer credit transaction secured by a first lien on real property or a dwelling other than a reverse mortgage subject to 102633 for which an escrow account was established in connection with the transaction and will be cancelled the creditor or servicer shall disclose the information specified in paragraph e2 of this section in accordance with the.

What Is A Closing Disclosure Finance Of America Mortgage

Closed End Home Equity Application Credit Union Form Http Www Oaktreebiz Com Products Services Closed End Home Equi Home Equity Home Equity Loan Credit Union

Home Equity Oak Tree Business Home Equity Credit Union Credit Union Marketing

How To Comply With The Closing Disclosure S Three Day Rule Alta Blog

Does Getting The Closing Disclosure Mean You Are Clear To Close Irrrl

The Home Loan Process Broken Down Into Steps Home Improvement Loans Loans For Bad Credit Small Business Loans

Take A Look At The Altaone Specials For Rv Loans Are Those Lending Documents In Compliance Commercial Lending Credit Union Business Systems

Home Oak Tree Business Credit Union Fourth Of July Business Systems

Closing Disclosure Form Fill Online Printable Fillable Blank Pdffiller

Understanding The Hud 1 Settlement Statement Lendingtree

Understanding Finance Charges For Closed End Credit

What Is A Closing Disclosure Finance Of America Mortgage

Home Equity Oak Tree Business Home Equity Equity Credit Union

Products Services Oak Tree Business Systems Video Video In 2021 Credit Union Commercial Lending Consumer Lending

New Mortgage Documents What Are They

What Is A Closing Disclosure Finance Of America Mortgage

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

/alta-sellers-closing-statement-26837264d4044785a5d0409dae83a510.jpg)

:max_bytes(150000):strip_icc()/alta-sellers-closing-statement-26837264d4044785a5d0409dae83a510.jpg)